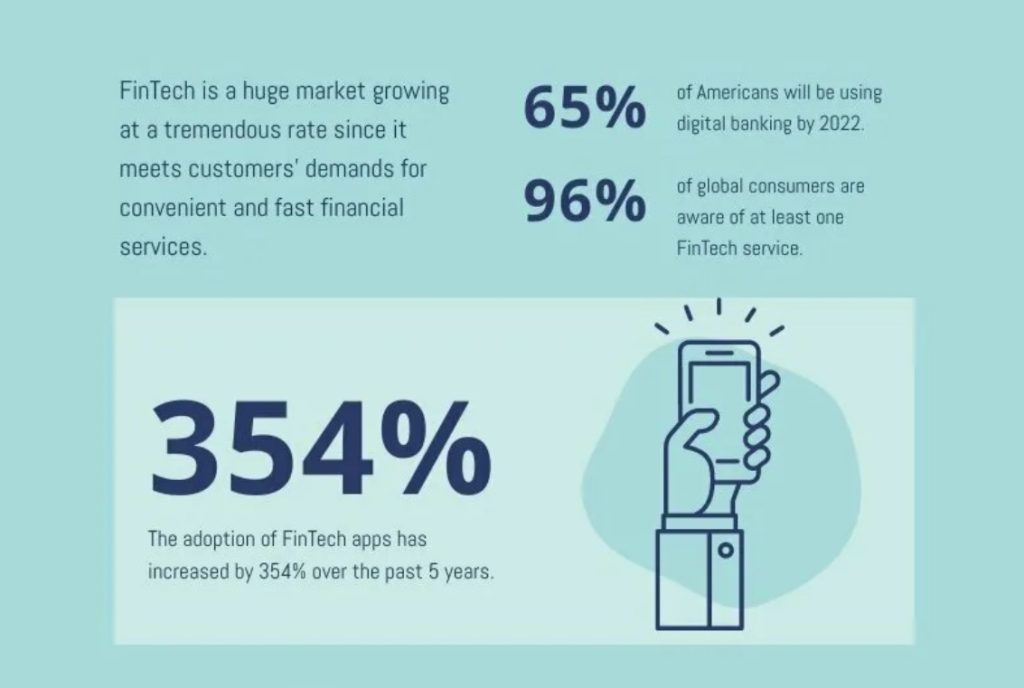

Over the past five years, the adoption of applications in the financial industry has increased by 3.5 times. More than 77% of financial institutions plan to increase the use of innovations, and by 2026 their volume is expected to exceed $305 billion. About a third of the investments go for the creation and support of mobile applications with advanced features.

However, it takes work to transfer a complex range of services to a mobile platform. It is essential to understand that customer loyalty directly depends on technological solutions provided for account management, loans, and insurance activities, as well as data security.

Let’s take a look at fintech app development challenges and learn how to deal with them efficiently.

10 Major Challenges in Financial Mobile App Development

Creating a banking app is associated with a number of risks, eliminating which is necessary to achieve a reliable and profitable product.

Data privacy & security

Finance is one of the most sensitive areas, so tackling security challenges and ensuring data privacy is the primary task of developers of any related applications, especially mobile ones. Such solutions must not have vulnerabilities, although, according to statistics, at least 80% of Android devices and a quarter of applications on Google Play are affected by all sorts of flaws.

Clients must trust you completely when it comes to their financial well-being. This is one of the main challenges in financial app development. If a user suspects that the credit card’s data has been leaked or the account has been hacked, they will remove your app. Your company will lose its reputation. That is why you must take beforehand measures to counter cybercriminals and involve professionals specializing in data analytics and security testing.

Regulatory-based challenges/data regulatory compliance

The financial industry is one of the most regulated. You need to make sure that the new product fully complies with relevant regulatory requirements. However, according to statistics, more than half of the applications still need to make some changes to satisfy them.

Whatever development method you use to overcome the major challenges in financial mobile app development, you must be aware of local laws regarding money laundering, cryptocurrency use, personal information protection, and account aggregation. Otherwise, you may be subject to sanctions.

User-friendly interface

A fairly large percentage of gadget users prefer mobile solutions to work with finances. Why so? Probably because they consider banking applications convenient and safe. To meet their expectations, the application must be all-around user-friendly. Clients should not have problems, from the first launch and up until they start to perform complex transactions. They need to enjoy using the app if you are looking to win over their hearts.

To overcome these challenges in fintech app development, you need to focus on solving recurring bugs, mending technical issues, and implementing design improvements. Regular collection of feedback from users is required as well.

Fast transaction time

The user needs their calculations and transfers to be carried out as quickly as possible, at an ultimate level of personal convenience. To ensure freedom of choice, it is necessary to widely implement payment functions, including innovative ones. Our experts consider P2P transactions, voice payments through digital assistants, and QR codes to be the most promising. Fast and hassle-free transactions are a must for successfully meeting the biggest challenges of financial app development.

Meeting customer requirements and market trends

Another must be studying the user experience across different ages, target user groups, and global trends. The functionality of the application should be extended according to the local characteristics of financial systems, insurance or business specifics, etc. You must be aware of them and have a clear outlook to avoid possible problems while developing a financial app.

For instance, our specialists implement application features such as:

- real-time balance check;

- real-time deposit check;

- personal assistant availability;

- real-time search for the nearest ATMs/banking branches;

- special offers.

Moreover, through applications, banks can provide discount coupons for purchases and partner services for their customers.

Keep in mind that every client wants to feel individual and special, so the emphasis on personalized services is essential. This will help to cope with real challenges in financial mobile app development. With a proper level of personalization, you can quickly launch a marketing campaign, establish contacts with partners, and coordinate finances with needs.

The right platform/operating system to develop

What could be better than seamlessly accessing services directly from your gadget? Users appreciate this opportunity a lot, so you need to provide the right set of personalized features and ensure compatibility with the operating system.

This presents certain difficulties in fintech app development. However, it’s important for the developer to choose the right platform to ensure that the application delivers the performance and functionality it intended to provide.

Customer retention issue

Your ultimate goal is to provide services to as many customers as possible and to make them want to stay.

One of the major best practices is to thoroughly study user experience and use the mobile-first approach. This will shorten the distance between you and your customers, who will enjoy enhanced omnichannel experiences. This will also stimulate their interest and your sales since the growth of this indicator by only 5% increases profits by a quarter.

You can also solve this type of challenge in the development of a financial mobile application with the help of:

- Push notifications;

- Analytics data offerings;

- Round-the-clock support.

The main thing is not to be too intrusive. Otherwise, you risk losing a significant part of active users.

Integration with other systems

The application must be compatible with previous versions of operating systems on different devices. It should seamlessly provide access to other software products and platforms, and its updates should ensure backward compatibility. Typically, this is achieved through cross-platform solutions that require professional skills to create.

Third-party API integrations

The product should easily adapt to different devices and screen resolutions. To tackle such problems in fintech app creation, we use:

- Server systems supporting mobile tools;

- REST API;

- Microservice architecture;

- Intelligent business rules to modify user callback options.

Deciding on a set of modern features

To determine the optimal set of features, it’s a good idea to start by building a product with a basic set of features (MVP). This will help bypass many of the challenges in developing fintech applications. Embrace new technologies because users love advanced features. Remember that they always choose the simplest and most reliable options and, on the other hand, the most functional and safe space for their money.

How to Overcome the Challenges in Fintech App Development

There needs to be a reasonable balance between security, transaction speed, integration with other systems, ease of use, fit for purpose, user behavior, and financial institution goals. But how to ensure all of this, and where to start?

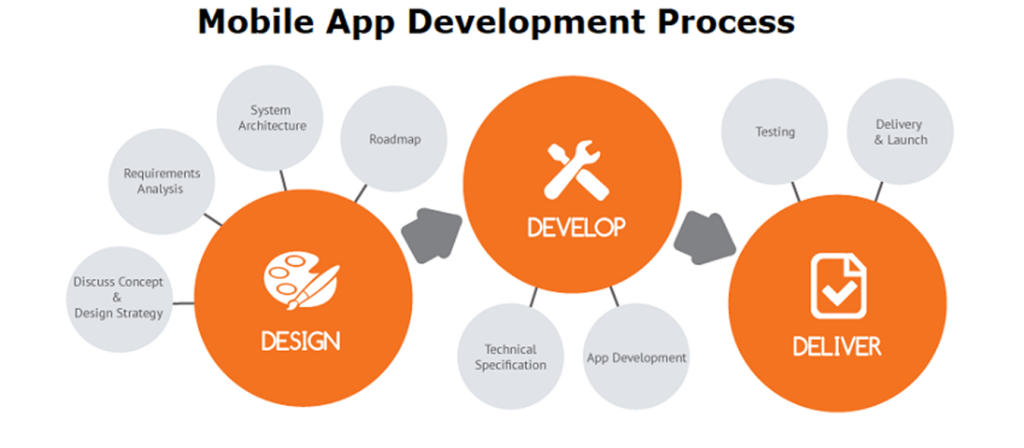

We consider the following algorithm the most appropriate for solving problems in fintech app creation.

Understand business goals and target audience

You must be sure there will be no trouble integrating the new product. Study everything that is on the market, and then answer the following questions:

- What do users need?

- What is your target market?

- Is your idea unique?

- What features should be prioritized?

- Where will you deploy the application, and what is its price?

To justify the necessity and possibility of implementing an idea, you need to rely on customer-oriented experience and an understanding of your own tasks.

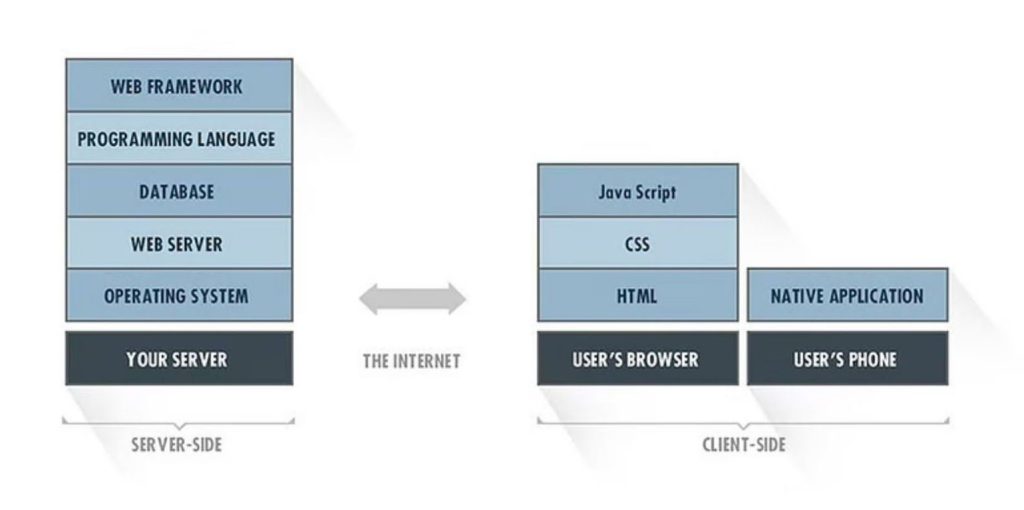

Finalizing tech stack

Different sectors of the financial market pursue different goals and objectives, so there can be no standard set of functions or universal technologies for their implementation. Compare the most used ones to highlight the ones that suit your needs.

The best technology stack is the one that offers the most benefit in tackling the challenges of financial app creation with the least amount of effort. Some suitable stack components may include:

- Server: Node.js, Tomcat, WebSphere;

- Database: MongoDB, Firebase, MySQL;

- Backend: JAVA, Python, DotNET, Ruby.

The size and scale of the application are shaped by its underlying capabilities, which must meet users’ expectations. The higher expectations are, the more complex the implementation.

At Weelorum, we use an iterative approach. Scaling the product concept to the MVP level makes it easier to prioritize tasks and keep a reasonable timeline. Agile methodologies are essential for quickly evaluating what works and what doesn’t. With this approach, you can effectively manage your own developers and, if necessary, hire a remote team.

Defining the right user experience

In the development process, it is important to focus on meeting the requirements of the market, the bank, and its potential customers. Follow market news and use data analytics to deal with common challenges of fintech app development and keep up with your competitors.

The user interface should be intuitive so that transactions can be made easily and new offers received quickly. Make sure your app is up-to-date and provides a perfectly balanced user experience. Leverage user input and third-party concerns in terms of your maintenance process.

Ensuring data privacy and security

Compared to other top challenges in developing a financial app, security breaches can destroy your reputation completely and scare off banks’ clientele. To avoid data protection-related problems, you need an effective network infrastructure, data architecture, and administration. We recommend using multi-factor authentication, including biometrics and secure codes sent via email or SMS.

Bank clients must be well-informed not only about the status of transactions. Use real-time notifications for the following events:

- Suspicious account activity;

- Attempts of unauthorized access;

- Low balance on the balance sheet;

Notifications can be duplicated in voice format. An application should not store sensitive data in a local file without encryption. Protect them with Keychain (iOS or Android). Regularly check the app for jailbreak/rooting or emulator attacks.

Integrating Artificial Intelligence and Big Data

Create a technology innovation management strategy. This is especially important for areas such as tax planning, investment, and pension payments. You’ll need the expertise to provide valuable contextual information, resolve requests automatically, and allocate resources intelligently.

Get industry-leading experts to help you achieve your ambitious goals!

Contact usOur Cases of Finance Mobile App Development

Choosing the right developer will ensure access to the best technologies, which will lead to results like one of our success stories — the iOS application John D.Rock. This financial planning application allows you to map out your budget for years to come, check your investments, and set goals you want to achieve. So, what are you waiting for? Let’s build an advanced solution that will allow you to effectively develop and manage business processes based on the latest industry trends!

Consider Weelorum as Your Trusted Partner in Developing Mobile Apps

We specialize in creating fintech applications and know what it takes to conquer users’ hearts. We can bring your ultimate business success closer with end-to-end application development services that have well-thought-out processes and affordable prices.

We start with a detailed market assessment, study your business and competitors, and then develop a clear and reliable strategy. We guarantee:

- A complex approach;

- Law compliance;

- Application security;

- Best monetization models and regular performance reports;

- Promotion;

- Competitor tracking and performance analysis;

- Full-cycle services.

Our team has deep knowledge of the Android and iOS platforms and is able to produce creative and future-oriented solutions. Our mobile application support services track key metrics and a wide range of user events.

We know financial app development’s main challenges, how to deploy across multiple devices and enter the market with a bang, regardless of device characteristics or operating system versions.

Final Thoughts

There are several challenges that developers will have to solve to build a reliable and on-point fintech solution. They need experience, knowledge, vision, and the ability to work effectively. And this is only possible with a well-tried professional team. If you do not have your own, hire on the side.

Want to get an engaging market-winning app at an affordable price?

Contact usFAQ

What are the main fintech app development challenges?

The key concerns of developers are ensuring the security of user data and the speed of transactions. At the same time, it is equally important to pay attention to regulatory requirements and the introduction of innovative features, technologies, and development methods.

How to efficiently tackle fintech app development challenges?

To make the application competitive, you need to carefully study the market, be able to hear the requirements of potential users, and recognize industry trends in time. It is crucial to have a team with experience in using key technologies.