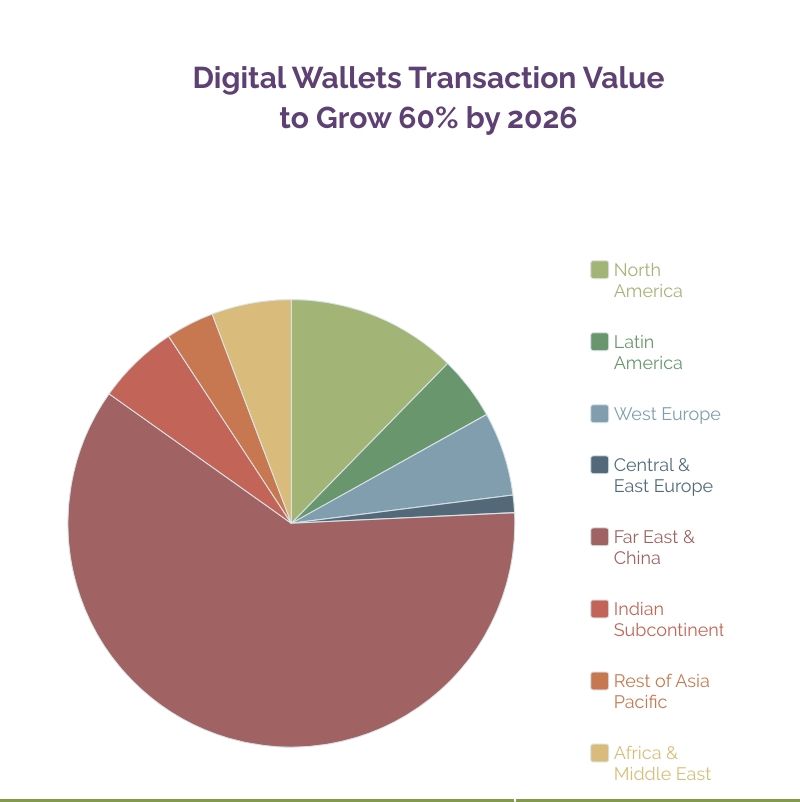

Electronic payments are increasingly replacing traditional methods of payment. This is especially true for mobile payments. Mordor Intelligence predicts that mobile payments will grow by 29.5% between 2021 and 2026. According to Juniper Research, the value of digital wallet transactions will increase by 60% by 2026.

The demand for digital financial services creates a need for new fintech solutions, and companies are trying to meet this demand because this niche is incredibly profitable. One of the most promising trends in this area is digital wallet applications. In this article, we’ll cover what an e-wallet is, how it works, and what you need to know before developing an e-wallet app, and we will provide a step-by-step guide on how to create a digital wallet.

What Is a Digital Wallet?

A digital wallet is software where users can store and use electronic money: pay for goods and services, transfer it to other users, etc. In most cases, digital wallets are used on mobile devices, but there are also desktop versions.

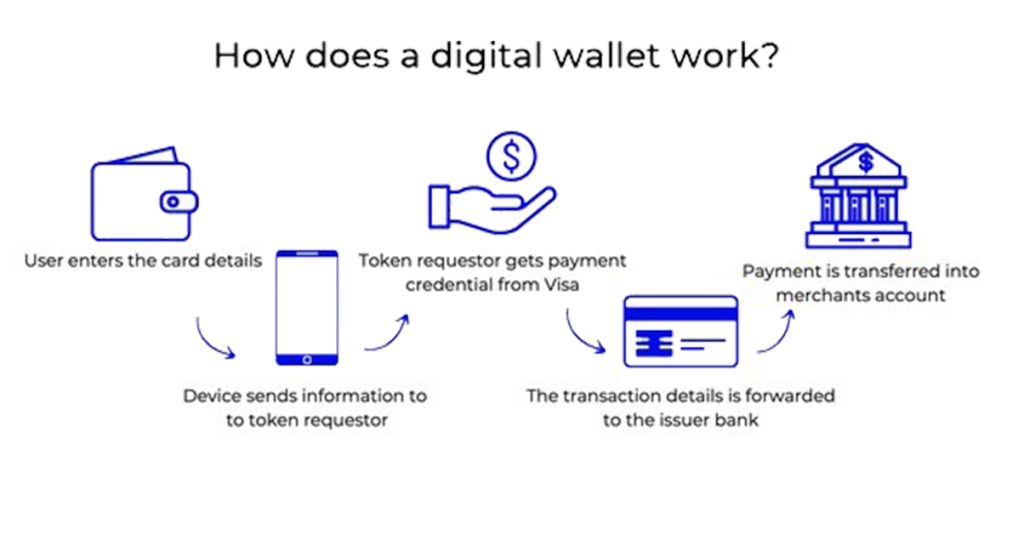

The principle of electronic wallet work can be described as follows:

- The digital wallet user starts an account and enters card data into it;

- The account data is stored encrypted on the device until the user wants to make a transaction;

- When the user wants to pay for a purchase, the device sends the entered token data to the requester and then to the buyer’s bank;

- The user confirms the transaction, and the bank transfers the funds to the merchant’s account.

Various technologies are used to make digital wallets more secure, such as near-field communication (NFC), magnetic secure transmission (MST), and QR codes. As a rule, the most common option in today’s digital wallets is NFC, which is needed to pay with a smartphone at mobile POS terminals.

Benefits of a Digital Wallet

Developing a digital wallet has a lot of advantages for businesses, but we will focus only on the main mobile app development trends of 2023.

Speed of transactions. Transferring funds from one wallet to another within the same payment system is a simple operation and is carried out instantly as there are no intermediaries in this chain.

Security. When making online payments with a plastic card, many people are afraid of fraud because they have to enter all the details from it. Having a digital wallet allows users to sleep well, thanks to modern security practices.

Convenience. Digital wallets are incredibly convenient to use. During every regular transaction, users have to enter the card’s number, CVV, the name of the owner, and the period of functioning. Owners of an electronic wallet just have to enter their password. Moreover, some digital wallets even offer several options for transferring virtual currency into cash through an ATM.

Develop your own digital wallet

Contact usDigital Wallet Types

To understand how to set up a digital wallet, you should learn about its types first. Digital wallets are divided into three main types: open, closed, and semi-closed. Let’s take a closer look at each of them.

Open wallet

An open e-wallet is similar in functionality to a bank card. Digital wallets of this type are usually issued by banks or associated institutions, and it allows you to pay for goods and services, transfer funds, and withdraw cash from ATMs. The most well-known representative of this type is PayPal.

Closed wallet

This type of digital wallet is designed for payments only within one particular platform. Getting a closed digital wallet on any service, the user can pay only for purchases on this service. A good example of this type is Amazon Pay.

Semi-closed wallet

Semi-closed digital wallets differ from the previous type by a larger number of companies where users can spend their money both online and offline. Of course, for a user to be able to pay with a company using a semi-closed digital wallet, the merchant should first sign an agreement with the issuers. Such wallets can also be issued by non-financial institutions.

Must-Have Digital Wallet Features

The number of functions in the developed digital wallet is limited only by the desire and budget of the software owner. Nevertheless, it is worth noting that too large and ambitious projects have a great risk of not being completed. That is why we compiled a list of must-have and good-to-have features, which you should focus on during wallet app development.

| Must-have features | Good-to-have features |

|---|---|

| Instant money transfer Integration with banks Accounts with multiple assets Control over transactions Exchange of currencies Security features | Membership cards Splitting of bills Gift cards Location targeting Exclusive offers |

Must-have features

- Instant money transfer. This function is the basis and reason for the existence of any digital wallet. Your task is to make the process of money transfer fast, seamless, and convenient.

- Integration with banks. Integration with banks can attract additional users and cover their financial needs.

- Accounts with multiple assets. The hallmark of good digital wallets is the ability to store funds in multiple currencies.

- Control over mobile wallet transactions. Users should be able to track their spending and account deposits.

- Exchange of currencies. If users can keep money in multiple currencies, there should be an option to exchange them within your service.

- Security features. NFC, two-factor authentication, and other important features.

Good-to-have features

- Membership cards. In the digital wallet, users may store membership cards of different organizations.

- Splitting of bills. If several users have your digital wallet, the splitting of restaurant bills, for example, can be very useful.

- Gift cards. Users may store gift cards from different stores in the digital wallet.

- Location targeting. Locating digital wallet users nearby is a great feature for funds transfer.

Exclusive offers. Your digital wallet users may have access to exclusive offers from associated merchants.

We know what features to implement

to attract and retain users

Contact us

4 Steps to Develop a Digital Wallet App

After learning about the benefits of digital wallets, the decision to develop this kind of software seems to be a very profitable endeavor. Nevertheless, it is worth understanding all the stages of a digital wallet development process in order to do everything correctly.

Discovery Stage and Prototype

First, it is necessary to thoroughly analyze the potential project, study your target audience, think over the architecture of the software, and create a detailed plan of future actions. This wallet development stage involves:

- Business analyst

- System architect

- UX/UI designer

Once the analysis is complete, you can start creating a prototype, which will contain only the most basic features.

Wallet Development and Quality Assurance

During this stage, software engineers write the code for the app, implement the planned features, and make the ideas come to life. As a rule, after implementing one part of the app, they check it for bugs, unexpected issues, and other imperfections to ensure the best quality for the final product.

App Launch and Promotion

When your product is ready and working properly, it’s time to release it. This stage is associated with the active promotion of a new digital wallet, involving brand ambassadors from among the celebrities and a lot of advertising.

Maintenance

However, it’s too early to rest after the release and recruitment of the user base. Next comes the post-release support for the digital wallet software to ensure it runs smoothly. You also need to add new features to steadily increase the number of users.

Main Challenges of Creating a Digital Wallet App

We’ve uncovered how to make a digital wallet and what benefits it brings, and now, let’s see what problems you may encounter on your way to success.

Fraud and Security

Having multiple layers of protection when developing a digital wallet is extremely important. Any security breach can result in significant reputational and financial risks.

Awareness and Adoption

A sizable portion of the population is still distrustful of digital wallets. That is why you should pay special attention to popularizing your solution and explaining how to use it.

Compliance with Legal Requirements

Financial regulations and laws can vary significantly from country to country. If you want your product to be global and successful, consider legal requirements at the design stage.

Device Compatibility

For maximum coverage of the user base, it is important to make the digital wallet available on as many devices as possible. It’ll be reasonable to develop a cross-platform digital wallet.

Best Ways for Keeping Your E-Wallet Secure

Passcode and Biometric Authentication

A unique passcode for logging into the application is one of the most effective ways to discourage intruders. Fingerprint or face authentication is also very effective for keeping a digital wallet secure.

Update Software Regularly

Regular software updates and vulnerability closures are common practices. You need to stay one step ahead of hackers and provide users with the highest level of digital wallet security in a timely manner.

Implement Two-Factor Authentication

Two-factor authentication is a simple but very effective way to prevent an attacker from capturing user funds. Confirming a transaction with an SMS code or another type of identity verification will significantly increase the application’s security.

Server Security

When developing a digital wallet, you should also be concerned about data security on your end. The user information you store should be protected to the highest standard using all advanced security systems.

Ensure your digital wallet security with Weelorum

Contact usConsider Weelorum as Your Trusted Partner

Creating a digital wallet product is a highly responsible and complex process that cannot be done without a reliable technology partner. That’s why we recommend turning to Weelorum. We are a custom software development company focused primarily on taking care of our partners and their business. The cornerstones of our work are a team approach to achieving set goals, simple communication methods, and a clear product development plan, so you won’t have any questions about how to estimate mobile app development properly.

We’ll create an app that makes mobile payments and investments a seamless experience. The most experienced developers, engineers, and UI/UX design services experts will help you create a world-class solution. We work with both B2C and B2B segments and can provide you with a powerful digital payment solution with multiple payment options, money management features, and advanced security measures. Contact us now, and we’ll start turning your idea into a reality together.

Significantly accelerate digital innovation in your company and become the owner of a truly powerful fintech product.

Contact usFAQ

How do I make money with digital wallets?

Having studied examples of the most popular e-wallet apps, we can conclude that their main source of income is transaction fees of 3-5%. Industries that benefit from mobile wallet application development are fintech, ecommerce, hospitality, etc.

What technology is used for mobile wallets?

The main technologies used for the development of digital wallets are NFC, MST, and QR code support. Moreover, it is possible to use AI and ML for fraud prevention.

How long does it take to create a digital wallet?

On average, developing an e-wallet app takes anywhere from a few months to a year. It all depends on the number of features you want and your plans for bringing the product to market and developing it.

How much does it cost to build a digital wallet?

To create a digital wallet that meets modern requirements, a business needs between $45,000 to $250,000. The price depends on functionality and the number of features in the final product.