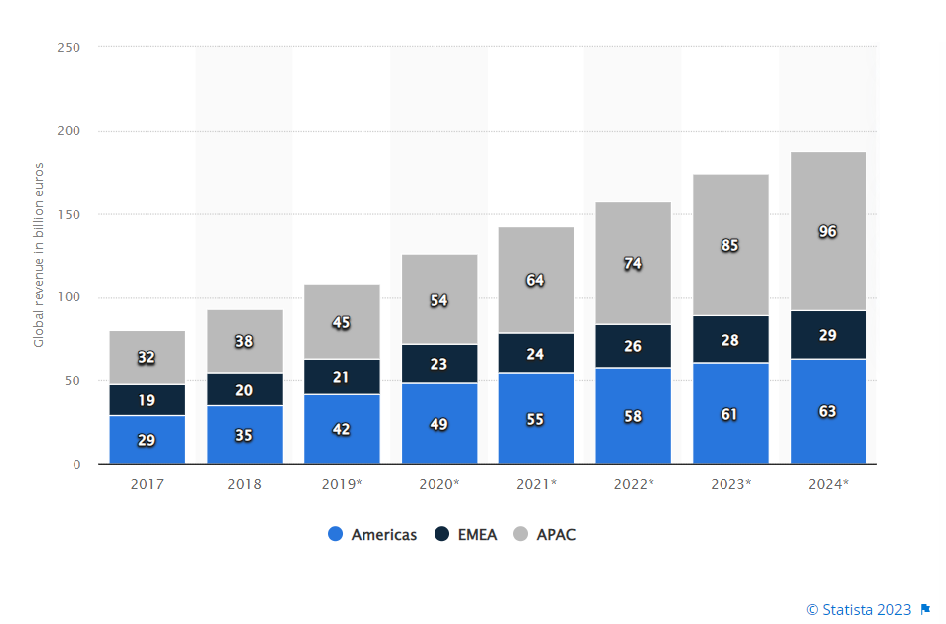

FinTech is a rapidly growing industry that recently emerged from the convergence of financial services and technology. Mobile applications are the most popular way to access financial services, and FinTech companies are continuously striving to develop the most secure, user-friendly, and innovative apps. According to a report by Statista in 2021, we had 10,755 FinTech startups registered in the USA. Moreover, the FinTech revenue generated is expected to reach 96 billion euros by 2024.

FinTech MoFintech sector revenue worldwide in 2017 and 2018 with a forecast until 2024, by region

(in billion euros)

However, it is not enough just to build an app. FinTech startups should focus on developing highly-targeted mobile apps that solve customer problems and create value to stay competitive. The main challenge that most FinTech companies face is how to make a FinTech mobile application that people will actually use.

From features to challenges and costs, this comprehensive guide will provide a thorough overview of everything you need to know about FinTech mobile application development. We will discuss why businesses need a custom mobile banking app, the benefits of developing a FinTech mobile app, the potential challenges you may face, and the estimated cost of this project. So, get comfortable, and take a look!

Table of content

What Is A FinTech Mobile Application?Types of Fintech Mobile AppsWhat Are the Key Features of FinTech Mobile Apps?Key Requirements Of Fintech App DevelopmentWhich Technology Stack is the Best for FinTech App Development?7 Steps to Develop a FinTech App5 Challenges in Developing FinTech Mobile ApplicationsHow Much Does It Cost to Develop an App for FinTech?Top 5 FinTech AppsConsider Weelorum as Your Trusted PartnerFAQWhat Is A FinTech Mobile Application?

FinTech mobile app is software related to the financial industry in one way or another and designed for mobile devices. FinTech includes a huge number of areas, such as payment services, investments, insurance, various types of loans, and non-banking. The most popular in this niche are companies creating a basic FinTech app in several directions at once and helping clients solve financial tasks in a convenient interface. The main features of FinTech mobile applications are an emphasis on security, personalization, and speed of services.

Types of Fintech Mobile Apps

With a better understanding of the various FinTech apps available, you’ll be able to make more informed decisions. Developing a FinTech mobile application is not easy, but first, you must choose the right app type. So, let’s explore the world of FinTech mobile apps!

Banking app

A mobile banking app is designed to help you manage your bank account. The app will allow you to check your account balance and transaction history, as well as transfer funds between accounts. Depending on which FinTech app you choose, banking apps can offer a variety of features, such as remotely checking deposits, travel money, budgeting tools, and international account accessibility.

Lending app

A lending app can be used to take out a loan or invest your funds. Today, these tools are becoming more popular as additional sources of income, with brands like Lendable and Moola offering lending services. These apps allow you to choose your amount, the interest rate, and the term length. The lending app connects you to a network of other investors and borrowers. You can also use it to take out a loan and invest your funds in peer-to-peer lending or crowdfunding options.

Investment app

You can use an investment app to diversify your portfolio, find new investment opportunities, and track your portfolio performance. Many FinTech investment apps are developed for experienced investors and offer access to premium features, like stock picking and portfolio analysis tools. Investment apps may also include features like retirement calculators, market forecasts, and research tools.

Consumer finance app

A FinTech app designed to help you manage your finances is a type of consumer finance app. These tools typically offer budgeting features, expense tracking, and savings goals and also include mobile payments and account management tools for your savings and investments. Advantages of a personal finance app include easy-to-use budgeting tools, effortless expense tracking, and convenient mobile payments.

Insurance app

You can use an insurance app to create a policy, check your coverage, and manage your insurance payments. Insurance apps are available for some of the most popular insurance types, including health, car, and home insurance. They allow users to view policy details and payment information, receive account updates, etc.

Looking for a trusted software development partner?

Our team is here to help to implement your ideas.

Contact usWhat Are the Key Features of FinTech Mobile Apps?

From budgeting tools to personalized advice, you should look out for various features to ensure that you get the best out of your mobile finance experience.

Personal account

Before building a FinTech mobile app, it is important to consider the type of account the app offers. Most mobile apps provide users with a basic account, however, FinTech apps specifically focused on personal finances provide a personal account that allows users to link multiple bank accounts, making it easier to manage their finances. Moreover, they can also see all of their finances in one place, making it easier to track and manage funds.

Payment gateway

It is essential to consider the payment options provided by the FinTech app. Certain apps allow users to make payments to other individuals, while others will give them the option to pay for goods and services. Whether it’s a cryptocurrency or a mobile banking app, a payment gateway is a must.

History of transactions and interactions

This feature allows users to track all of their finances and will inform them of any potential issues they may face. This includes keeping track of spending and any budget users have set up. The main goal of this feature is to monitor finances and make adjustments when needed.

Customer support

Users always have questions or face some issues while using an app. Make sure you have a support team ready to process these requests 24/7. A quick response can go a long way in reassuring your users about the quality of your app and its support. A solid FAQ is also a must-have for an app.

Chatbots

As technology progresses, FinTech apps are beginning to offer the use of chatbots. Chatbots are artificial intelligence systems that can help with various functions within the app. This includes helping users to track their spending and informing them of any issues with their finances.

Personal spending analytics

FinTech apps also provide analytics that enable users to control their spending. They can see how their spending changes over time, allowing them to make adjustments as needed. This can be useful for those who want to use the finance app as a tool to manage their spending.

Key Requirements Of Fintech App Development

Financial app development is a highly responsible multi-step process. For everything to go as smoothly as possible, you need to plan every aspect in advance and carefully study all the basic requirements for developing a FinTech mobile app. Let’s take a look at the key points in the FinTech product development process.

Security

This is the most important requirement for any FinTech software, regardless of its function and place on the market. First, the FinTech market is strictly regulated. In order for an application to be officially released and allowed to work by regulators, it must comply with PCI DSS and other regulatory documents. But even without those requirements, the lack of security would scare the users away because it’s their money we are talking about, and therefore the slightest failure could ruin your reputation.

Integrations

A good FinTech software must be user-friendly and thus must have the ability to integrate with third-party services for expanded functionality. This can be achieved with an API-first approach.

Simplicity

Users don’t want to spend much time understanding all the intricacies of the financial app. It is especially true for people not well-versed in modern technology. For this reason, it is vital to provide the simplest but, at the same time, the most functional interface when you develop contemporary FinTech apps.

Support

Among the advantages of good FinTech solutions, there is also the support of users in case of emergencies. Ideally, such support should be provided 24/7 and with the implementation of the latest AI technologies.

Which Technology Stack is the Best for FinTech App Development?

Let’s run over the best tech stacks needed for building FinTech applications. A lot depends on the mobile platform you are targeting. How to make a FinTech app for iOS and Android? What tools are used? And how to make a FinTech mobile app that will be competitive on the market? Here’s an overview of the main tools used for this purpose:

iOS

- Language: Objective-C, Swift.

- Core: iOS SDK, CocoaTouch / Multimedia.

- Analytics: Firebase, Facebook, AppsFlyer.

- Data: Realm, UserDefaults, KeyChain, CoreData, CryptoSwift.

Android

- Language: Java, Kotlin.

- Core: Android Jetpack, Android SDK.

- Analytics: Amplitude, Firebase, Facebook, AppsFlyer.

- Data: Realm, Shared Preferences, SQLite, Room.

Cross-Platform

- React Native

Wish to take your FinTech business to the next level?

We can help you realize your ambition and goals.

Contact us7 Steps to Develop a FinTech App

The mobile application development for FinTech consists of several stages. Each is equally important and requires a high level of expertise to carry out all the work in strict compliance with the budget and agreed terms. Let’s consider each stage of custom FinTech app development in more detail.

Analysis and research

Everything begins with the preparatory phase of building a mobile app for FinTech. When a client approaches the company with a request to develop a FinTech application, first, it is necessary to carry out thorough analytical research. As a rule, business analysts study the market, form a portrait of the target audience, and carefully study the competitors. These steps will allow them to design software in the future, not blindly, but with clear guidelines.

Prototyping

The next stage of making a FinTech solution is the design of the future application. Experts select the best tools and tech stack and create the architecture of the future application. Sometimes this stage also includes prototyping, during which developers create a prototype with a minimum number of functions. This prototype can then be further developed into an MVP of a FinTech app (minimum viable product).

UX/UI design

After the development team has a clear plan for FinTech software creation, UX/UI designers are put to work. They perform two main tasks. The first is to create the logic of interaction between interface elements. It is crucially important for users to utilize all the software features comfortably and that the arrangement of elements does not conflict with each other. The second is the creation of the look and feel of the app. Designers ensure that FinTech software has a pleasant appearance and that all elements correspond to the client’s brand identity.

Development

The next stage of creating a FinTech app is code writing. This stage is also divided into two substages: frontend and backend development. During the frontend development, the developers create the part of the application which the user will directly interact with. In turn, the development of the backend is the creation of the server part, hidden from the eyes of ordinary users.

Testing

After the code is written and the application is almost ready for release, the final stage of FinTech software creation begins. After every feature is ready, QA engineers check it for bugs and unexpected issues so that nothing can taint the user experience.

Post-release support and maintenance

Once the software is ready for release, the work doesn’t end. Next, specialists need to ensure its smooth operation and make sure that everything works as it should. In the context of FinTech software, this is especially important since users’ money is at stake here, and therefore even a short-term failure can entail serious reputational and financial risks.

Evolution of software

When the product is ready and working, and users are already starting to arrive, it is worth thinking about improving your brainchild. In fact, this stage starts the whole cycle of software development from the very beginning. Specialists research the market, identify features that can make the application better, and then implement them.

5 Challenges in Developing FinTech Mobile Applications

Let’s run over five of the biggest obstacles when building a FinTech mobile app and how to surmount them. By understanding and preparing for these challenges, developers can create successful, secure, and compliant mobile applications that meet the modern consumer’s needs.

Fintech App Security

The main challenge developers usually face is how to develop a FinTech app that will be safe for users. When building a FinTech app, developers should begin with a security-first mindset. This means they should understand the risks associated with the app and find ways to mitigate them.

In addition to minimizing risks, developers must follow their organization’s security guidelines. All financial organizations must comply with a set of regulatory security standards, such as the Payment Card Industry Data Security Standard (PCI DSS). This standard outlines the technical, administrative, and physical security controls that financial organizations must implement to store, process, or transmit cardholder data.

Focus on Target Audience

FinTech apps are used by various people, from consumers to businesses. As such, developers should focus on the target audience for their app. This means that they should consider the needs and desires of their target audience and their demographic and psychographic data. For example, an app designed for college students should include features such as social media integration and push notifications. In contrast, an app designed for small business owners should have features such as inventory tracking and stock management.

Once the target audience has been identified, the next step is understanding their habits and preferences. This can be done through market research, such as surveys, focus groups, and interviews.

Cyberattacks protection

Protecting against cyberattacks is one of the top concerns among FinTech developers. While security is an ongoing process, building it into the development of a FinTech mobile app lifecycle is essential.

Developers must understand their app’s risks and vulnerabilities and then put security measures in place to mitigate them. This is especially true for FinTech apps that store or transfer sensitive information, such as payment apps and apps that store personal data. It is of utmost importance to set up the system so it can quickly respond to data leakage.

Building the right architecture

Another challenge that programmers usually face is how to develop a FinTech mobile app with the proper architecture. The architecture is the foundation upon which the app is built. It can be likened to the house frame in that it provides the foundation, structure, and support for the rest of the app.

If the architecture is not built correctly, then the app will be made on a faulty foundation, which could lead to a less-than-optimal app. This could mean that the app is not scalable, not cost-effective, or perhaps it cannot meet regulatory requirements. In order to build the right architecture, developers must understand the needs of the app and the available resources.

Good usability

FinTech apps are used by people from all walks of life and with many different backgrounds. This means that apps must have a user-friendly interface and be easy to navigate for every customer, regardless of their knowledge level or proficiency with technology. To ensure the app is easy to use, developers can employ some usability testing techniques. These tests can identify any usability issues and then determine how to fix them. Developers should also use empathy mapping, a technique that helps designers and product managers think about how their target audience will use their app.

How Much Does It Cost to Develop an App for FinTech?

Before you invest in the development of a FinTech application, it goes without saying that you want a viable return on your investment. To this end, getting a handle on the costs of creating an e-commerce app is important.

The final price depends on the type of app you want to make, the level of complexity, the technology stack you plan to use, the type of skills required to build the app, the scope of the project, and the timeline you have in mind. On average, building a FinTech mobile app solution will cost between $45,000 and $300,000.

Here is a list of specialists needed to develop a FinTech mobile app:

- Back-end developer

- Mobile app developer (Android and iOS)

- QA team

- Project manager

- UI/UX designer

- Product analyst

- Business analyst

Want to plan a budget for your FinTech application?

Don’t hesitate and contact our team for an accurate estimate!

Contact usTop 5 FinTech Apps

Let’s review the most successful FinTech apps on the market.

MoneyLion

MoneyLion is an automated personal finance platform that helps you manage your finances. With MoneyLion, you can easily track your expenses, create a budget, and even get loans and credit. It’s an ideal platform for anyone looking to get their finances in order. In the first quarter of 2022, the adjusted gross profits of this app reached $40.3 million. Overall, it’s an excellent way to track your money, set a budget, and save funds.

Nubank

Nubank is an innovative app that allows you to manage your personal finances and make secure payments easily. With its intuitive design and user-friendly features, Nubank is one of the greatest budgeting apps that allows you to track your spending. Plus, it offers exclusive benefits, like cashback rewards, zero-fee international transfers, and discounts on products and services.

Revolut

Revolut is a revolutionary app that is quickly becoming a leader in the financial technology industry. With more than 15 million registered users, this app provides them with a wide range of features and services, from managing their money and budgeting to spending and investing. Revolut’s main focus is on providing an easy, secure, and fast way for customers to manage their finances and make payments. You can also use it to transfer money abroad with low fees (all users have ten free international transfers per month) and get access to exclusive discounts and rewards.

Coinbase

Coinbase allows users to securely store cryptocurrency on their mobile devices, as well as buy, sell, and transfer funds to and from other users. The app also features an easy-to-use interface, making it simple for even novice investors to get started. Coinbase also provides various security features to keep your funds safe, such as two-factor authentication and multi-signature wallets.

Robinhood

One of the most popular stock trading apps that help users easily invest in the stock market. The app was created to make investing more accessible and affordable for everyone. With Robinhood, users can buy and sell stocks with no commission and account minimums. Additionally, the app provides tools and resources to help users make informed decisions, such as real-time market news and charts.

Consider Weelorum as Your Trusted Partner

Looking for a partner you can trust with your mobile app development? Weelorum is a FinTech app development company specializing in designing, developing, and deploying mobile apps for the FinTech industry. We know how to create a FinTech mobile app that will surely meet your company’s needs. With the latest trends in FinTech, we have expertise in building the most suitable mobile apps to fit the requirements of the financial sector.

Moreover, we have a decent experience in this area.

Recently, we have built the John D. Rock app that allows users to integrate financial accounts and keep track of their assets, investments, and liabilities. With this tool, users can create customized financial plans and investment roadmaps to help them achieve their goals.

Overall, if you are looking for a reliable partner that understands how to create a FinTech app and has many years of field experience, we are always here to assist you. Endeavor to visit our website and explore more information about us!

FAQ

What are the challenges in the development of a FinTech app?

One of the biggest challenges is understanding the regulations and requirements that come with offering financial services.

Additionally, you need to ensure that your app is secure and reliable. This means using the latest technologies and best practices to protect user data and keep transactions safe. You'll also need to consider user experience and usability. However, if you hire a professional to do this job, you can rest assured that all these challenges will be met.

What are the main features of a FinTech app?

The main features of a FinTech mobile app are a payment gateway, personal account, customer support, history of transactions, and personal spending analytics. However, the final list of features depends on your business goals.

What is the cost of developing a FinTech app?

The costs of building a FinTech application start from $45,000, but the overall investment can vary significantly depending on the app’s features and the development company. The average cost of a FinTech app falls between $50,000 and $300,000.